By: Ochuko Okor

Introduction

The affordable housing crisis in the US is an issue of national concern. Across the country, a large percentage of low-income earners are faced with high costs and a dwindling supply of affordable homes. No state in the US has enough affordable homes to meet the demand of low-income renters and housing costs continue to rise faster than wage growth.

In Florida alone, there are 531,397 extremely low-income (ELI) renter households with a ratio of 28 affordable rental units per 100 ELI households (SOURCE: NLIHC). According to the National Low Income Housing Coalition (NLIHC), there is an estimated shortage of 6.8 million affordable rental homes for ELI families/renters. These numbers are concerning given the established link between housing and building intergenerational wealth, bolstering economic growth, and reducing childhood poverty. The lack of affordable housing in communities can have a host of negative impacts on the community’s social and economic abilities.

The Problem

The NLIHC reports a loss of approximately 2 trillion dollars in low wages and productivity due to a shortage of affordable housing. This begs the question: why is there a shortage of affordable housing? The answer is multifactorial, ranging from the cost of labor and construction materials to low wages and rent surges to zoning and affordable housing laws.

Housing Shortages

Cost of Labor and Construction

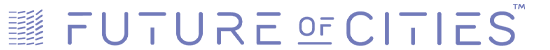

The cost of labor and construction materials have been rising exponentially since 2009, making affordable housing expensive to build. This has only been compounded by the Pandemic and a series of natural disasters, leading to our current hyperinflation situation. According to the National Association of Homebuilders, the cost and availability of labor were reported as a significant problem for 82% of builders in 2021, compared to 13% in 2011. The shortage of construction workers has been an ongoing problem, as the labor force has not been able to recruit and retain the skilled labor force needed to meet the demand of more than half a million skilled workers.

On the other hand, the producer price index (PPI) of raw materials used in construction has risen an estimated 24% since 2008 according to the Bureau of Labor Statistics. Residential developers are focusing on the luxury housing market which provides a high-profit margin. When these developers construct ‘affordable’ housing, the prices are marked up because the housing demand exceeds supply.

Housing Poverty

Funding Vs Income Vs Rent

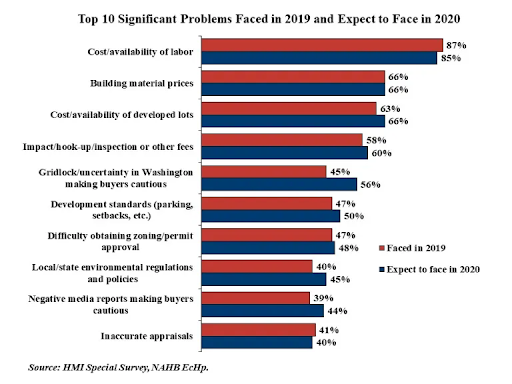

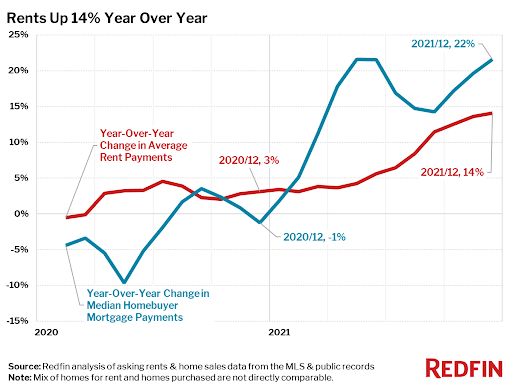

One of the major glaring causes of the affordable housing crisis is the inability to afford rent and sale prices of homes. According to a Redfin survey, the average year to year rent prices experienced a surge of 14% bringing the national average monthly rent, as of December 2021, to $1,877. Major metro areas saw a rent increase of over 30%. Austin, Texas rents increased by 40% bringing the average monthly rent in Austin to $2,290 in December 2021. A household making $50,000 per year in this market would be forced to pay 55% of their income on monthly rent. In addition, these prices do not include the extra burden of the cost of transportation, feeding and other services for daily sustenance. This household would be described as cost-burdened.

The NLIHC defines a cost-burdened household as one that spends 30% of their untaxed income on rent and utilities, which accounts for about 45% of households nationally. 70% of ELI families and households in the US are cost-burdened as they spend more than half off their income on rent. There are numerous existing housing programs that are designed to assist low income families financially, but many of these programs are underfunded, as a result, they are not able to efficiently provide financial assistance to all who come to them. In fact, 3 out of 4 low income renter households in the U.S. that need assistance, do not receive it.

Zoning Laws & ‘Not In My Backyard’ (NIMBY)

Zoning laws place artificial limits on when and what kind of property can be built either by restricting certain factors such as the height of the building, parking spaces, or development of housing types (i.e. multiple family units, etc). These zoning laws have historically and disproportionately affected low-income and minorities from access to affordable housing by driving up property values, increasing construction costs, and creating a decrease in supply. These laws continue to fuel gentrification and force a spatial distribution of people and jobs. Behavioral characteristics like ‘not-in-my-backyard’ driven by community opposition to affordable housing developments creates a stigma for affordable housing and have caused a hindrance in where affordable housing units are located or built.

Natural Disasters

Natural disasters have a huge impact on the housing market; it contributes to disruptions in the supply chain, labor shortages and shortages in essential construction materials. Natural disasters have increased in frequency and intensity due to climate change. According to CoreLogic’s 2021 climate change catastrophe report, 1 in 10 US residential homes in the US were affected by natural disasters. This means a large number of homes were either destroyed or in need of reconstruction as a result of natural disasters like hurricanes, tornadoes or flooding. These events have also caused the rise and fall of rent prices in affected and neighboring areas.

The Solutions

Increased Funding and Wages

It is clear that there are numerous contributors to the lack of affordability of homes, and a simple increase in the supply of housing units will not be enough to curb the existing issues. An evident step is to increase employee wages to compete with rising market prices. Cost of living varies differently from city to city but with the national average inflation rate rising by 4.7%, goods and services are not getting any cheaper. Higher wages will help increase a household’s financial freedom.

Another approach is to invest in innovative ways to create and sustain financial subsidies to cover either a fixed percentage of housing rent or other costs. For a local level variation of the housing choice vouchers or Section 8, there can be community-level housing choice vouchers that are co-funded through private and public partnerships. Co-partnerships in financing housing programs can raise the potential of catering to more households in need of financing. It can also empower and support families to seek out affordable housing opportunities and usher them into an equity position.

Housing Stock

The housing stock needs to be populated with various housing types that can contribute to the reduction of the cost burden on low-income households in general. Concepts like row houses, and the missing middle housing, which introduces buildings like triplexes and fourplexes, will allow for the creation of denser and compact housing units within high-demand areas. Manufacturing and prototyping housing concepts like 3D printed homes and modular units can be explored to reduce the dependency on the typical raw materials used in housing construction like lumber. Multiple housing concepts like these allow neighborhoods to cater to different types of households while offering varying prices to families.

“The government has an obligation to provide financial support to everybody to find good housing, whether they can afford it on their income or not.”

– Jenny Sheutz,

How To Fix America’s Broken Housing Systems Podcast

YIMBYism & Equitable Access

It is clear that existing housing ordinances are not functioning appropriately, and they need to be revamped to equitably work for all people. The rise in housing prices and unequal spatial distribution of employment has accounted for social and economic inequalities. Many jobs tend to be in metro areas, which are surrounded by overpriced homes due to proximity to downtown amenities. Rapidly developing urban centers attract higher income households; this forces lower income families to move out to more affordable areas, which are typically in suburban areas. A large number of people move outside to areas where there’s not enough housing units built for the large inflow of cost burdened workers.

It is important that both existing and future households are protected from facing challenges due to rising tax rates, discriminatory zoning laws, and redlining. More inclusive and equitable laws should be put in place to protect households from unfair eviction and to allow families more housing options to apply for. New advocacy groups are slowly on the rise bolstering the ‘YIMBY’ or ‘Yes, In my Backyard’ prohousing movement advocating for rezoning and increased housing stock. California YIMBY, for instance, has worked to pass bills like SB-9 on a statewide level to abolish single-family home zoning and allow for the construction of more affordable and multiple building types (plexes).

ELIs and families that seek out affordable housing can also benefit from increased educational awareness on their ownership rights. One way to do this is through frequent and easily accessible opportunities of informational dispersal through public housing workshops, classes and mentoring sessions. This way households will be informed on how to generate wealth and empowered to make smart borrowing, renting and purchasing decisions.

Conclusion

The conversation about affordable housing continues, with so much data being accumulated on what the obstacles and possible solutions are, many families are still being plagued with the issue of affordability. Rising costs of materials, rent and unfair zoning laws are only exacerbating the problem and radical action on the housing system needs to happen. There should be more innovative exploration towards housing laws, financing and ensuring the growth of the affordable housing stock made available for households. The hope is that in the near future, more private and public copartnerships will drive an increased effort towards affordable housing initiatives that can turn this conversation around.

Sources:

https://www.cnn.com/2022/02/16/perspectives/affordable-housing-crisis/index.html

https://www.globest.com/2021/08/27/the-affordable-housing-crisis-is-getting-worse-say-experts/

https://reports.nlihc.org/gap/press-contact#graphics https://reports.nlihc.org/gap/2019/fl